Top AI tools for Loan Officer

-

finbots.ai AI Credit Scoring to Boost Lending Profits and Reduce NPLs

finbots.ai AI Credit Scoring to Boost Lending Profits and Reduce NPLsfinbots.ai offers creditX, an AI-powered credit scoring solution that helps lenders increase approvals, reduce risk, and improve efficiency.

- Contact for Pricing

-

Prodigal AI agent for servicing and collections – integrated out-of-the-box and live 24/7 across voice and digital.

Prodigal AI agent for servicing and collections – integrated out-of-the-box and live 24/7 across voice and digital.Prodigal is an AI-powered platform designed for loan servicing and collections in consumer finance, automating operations and providing actionable insights to increase payments and agent effectiveness.

- Contact for Pricing

-

Dovly Unlock Your Best Credit Score with AI

Dovly Unlock Your Best Credit Score with AIDovly's AI-powered engine simplifies credit building, repair, and protection. Achieve significant credit score improvements and reach your financial goals.

- Freemium

- From 9$

-

Mainlend Best-in-class Loan Management Software For Automated Digital Lending

Mainlend Best-in-class Loan Management Software For Automated Digital LendingMainlend provides comprehensive loan management software with an automated decision engine and loan product builder to streamline lending processes from application to servicing, offering a digital lending platform for businesses.

- Contact for Pricing

-

Layerup Human-like voice AI for financial institutions

Layerup Human-like voice AI for financial institutionsLayerup provides AI-powered voice agents for financial institutions, handling collections, payment reminders, and loan servicing with human-like interactions across multiple communication channels. The platform enhances engagement rates by up to 70% and response rates by up to 90%.

- Contact for Pricing

-

Homeppl Customer risk made simple with AI-powered fraud detection and affordability analysis.

Homeppl Customer risk made simple with AI-powered fraud detection and affordability analysis.Homeppl is an AI-driven platform that reveals customer risk, detects application fraud, and qualifies more customers globally through advanced financial data analysis and fraud prevention technology.

- Contact for Pricing

-

Salient AI loan servicing platform built specifically for automotive finance

Salient AI loan servicing platform built specifically for automotive financeSalient is an AI-powered loan servicing platform specifically designed for the automotive finance industry. It streamlines operations like loan onboarding, collections, and compliance using AI agents.

- Contact for Pricing

-

AviaryAI AI Outbound Voice Agents and Knowledge Base for Financial Institutions

AviaryAI AI Outbound Voice Agents and Knowledge Base for Financial InstitutionsAviaryAI offers AI-powered outbound voice agents and a knowledge base tailored for credit unions, banks, and insurance providers to enhance customer engagement and streamline operations.

- Contact for Pricing

-

MyLoans.ai Free AI Guidance for Complex Student Loans

MyLoans.ai Free AI Guidance for Complex Student LoansMyLoans.ai is an AI-powered platform that provides instant, personalized student loan guidance to help borrowers navigate complex loan decisions and potentially save thousands in repayments.

- Free

-

Boss Insights Business Data As A Service bridging data gaps between banks and business customers.

Boss Insights Business Data As A Service bridging data gaps between banks and business customers.Boss Insights provides a Business Data as a Service platform, offering real-time access to standardized business data via a single API for financial institutions and fintechs to enhance decision-making and customer engagement.

- Contact for Pricing

-

New Silver Your Trusted Real Estate Lending Partner

New Silver Your Trusted Real Estate Lending PartnerNew Silver provides hassle-free online loan approval and fast funding for real estate investors, offering various loan products including fix & flip, rental, ground up construction, and commercial loans.

- Contact for Pricing

-

Rollee Leverage alternative data to underwrite anyone.

Rollee Leverage alternative data to underwrite anyone.Rollee accesses alternative data sources like gig platforms and government portals to verify income, work history, and tax data, enhancing risk analysis and underwriting for diverse workforces.

- Contact for Pricing

-

Ntropy Insights Save 80% on underwriting a business using AI and bank data.

Ntropy Insights Save 80% on underwriting a business using AI and bank data.Ntropy Insights utilizes AI with bank data to automatically generate Profit & Loss (P&L) and cash statements in milliseconds, significantly accelerating the business underwriting process.

- Contact for Pricing

-

SmartDispute.ai Repair your own credit using the power of artificial intelligence

SmartDispute.ai Repair your own credit using the power of artificial intelligenceSmartDispute.ai is an AI-powered credit repair system that helps users identify and remove negative accounts affecting their credit score through automated dispute generation and tracking across all three credit bureaus.

- Paid

- From 49$

-

Heron Automate Your Document-Heavy Work

Heron Automate Your Document-Heavy WorkHeron uses AI to automate document intake, data extraction, enrichment, and synchronization for businesses, streamlining document-heavy workflows.

- Contact for Pricing

-

Synapse Analytics Revolutionize Credit Decisioning with AI-Powered Precision.

Synapse Analytics Revolutionize Credit Decisioning with AI-Powered Precision.Synapse Analytics is an AI credit decisioning platform designed to increase loan approvals, reduce risk, and streamline operations for financial institutions.

- Contact for Pricing

-

Pagaya AI-powered credit analysis for smarter lending decisions

Pagaya AI-powered credit analysis for smarter lending decisionsPagaya is an AI-powered financial technology platform that helps lending institutions analyze credit applications and make better lending decisions without increasing risk.

- Contact for Pricing

-

Mortgage+Care Comprehensive Loan Servicing and Origination Management

Mortgage+Care Comprehensive Loan Servicing and Origination ManagementMortgage+Care delivers affordable loan servicing software featuring origination, escrow, investor portals, trust accounting, integrated collections, and comprehensive reporting capabilities.

- Contact for Pricing

-

Doc Doctor Pay As You Go AI-Powered Bank Statement Conversion That Actually Works

Doc Doctor Pay As You Go AI-Powered Bank Statement Conversion That Actually WorksDoc Doctor is an AI-powered tool that converts bank statements into various financial formats with industry-leading accuracy and bank-grade security, designed specifically for financial professionals.

- Freemium

- From 29$

-

Mortguage.app Fast, Simple Mortgage Payment Calculator

Mortguage.app Fast, Simple Mortgage Payment CalculatorMortguage.app provides instant mortgage payment estimates, helping users budget and plan for home loans with ease and confidence.

- Free

-

Surefire CRM by Top of Mind Networks Automated Mortgage Marketing and CRM for Lenders

Surefire CRM by Top of Mind Networks Automated Mortgage Marketing and CRM for LendersSurefire CRM delivers automated, compliance-ready marketing and customer relationship management tailored to the mortgage industry, helping lenders nurture leads, manage pipelines, and engage clients through omni-channel campaigns.

- Contact for Pricing

-

MobiFin Unified Digital Banking and Payments Platform

MobiFin Unified Digital Banking and Payments PlatformMobiFin is a comprehensive digital banking and fintech platform designed to deliver seamless financial services, including digital wallets, core banking, loan management, and agency banking, empowering banks and fintechs with secure, integrated solutions.

- Contact for Pricing

-

Should I Pay Off Loan AI-powered financial analysis for smarter loan payoff decisions

Should I Pay Off Loan AI-powered financial analysis for smarter loan payoff decisionsShould I Pay Off Loan is an AI-driven tool that helps users evaluate the financial, emotional, and credit score implications of paying off loans versus investing, providing personalized recommendations without storing personal data.

- Free

-

EarnUp Autonomous Financial Wellness Platform with AI-Powered Financial Genius

EarnUp Autonomous Financial Wellness Platform with AI-Powered Financial GeniusEarnUp is an award-winning AI-powered financial wellness platform that automates debt paydown and savings for consumers while providing financial institutions with engagement tools to improve customer retention and reduce risk.

- Contact for Pricing

-

KlearStack Eliminate Manual Document Processing Using AI

KlearStack Eliminate Manual Document Processing Using AIKlearStack is an AI-powered platform designed to automate document processing, enabling fast and accurate data extraction and compliance auditing for businesses.

- Paid

- From 300$

-

Jisort Simplify Your Banking with Jisort

Jisort Simplify Your Banking with JisortJisort is a secure, cloud-based core banking system that empowers financial institutions to manage loans, accounts, customers, and reporting all in one platform, enabling the launch of digital banking products in hours.

- Usage Based

-

Validit.ai Your #1 Defense Against Fraud

Validit.ai Your #1 Defense Against FraudValidit.ai is an AI-based fraud prevention service that assesses human intent using behavioral science and bio-signal processing to safeguard businesses.

- Contact for Pricing

-

ProcessorIQ Transform and Organize Loan Documents Instantly with AI

ProcessorIQ Transform and Organize Loan Documents Instantly with AIProcessorIQ is an AI-powered platform that converts, labels, and risk-checks mortgage files, streamlining document management for mortgage professionals. Experience faster, smarter, and more organized loan cycles with automated PDF conversion and intelligent alerts.

- Freemium

- From 25$

-

RiskSeal Smart decisions through digital footprints

RiskSeal Smart decisions through digital footprintsRiskSeal is a global platform for alternative credit risk data that provides 400+ instant data points and digital credit scoring through analysis of digital footprints across 200+ online platforms.

- Usage Based

- From 499$

-

Ocrolus AI-driven document processing automation with Human-in-the-Loop

Ocrolus AI-driven document processing automation with Human-in-the-LoopOcrolus is an intelligent document processing platform that helps lenders automate financial document analysis, detect fraud, and make faster, more accurate lending decisions.

- Freemium

-

StubCheck.com Generate Professional Paystubs Instantly and Accurately

StubCheck.com Generate Professional Paystubs Instantly and AccuratelyStubCheck.com offers an online paystub generator with intelligent algorithms to create professional, state-compliant paystubs in minutes, simplifying payroll for businesses, employees, and contractors.

- Freemium

-

Smart Solution Accelerate Financial Evolution Through Core Banking Innovation

Smart Solution Accelerate Financial Evolution Through Core Banking InnovationSmart Solution delivers advanced banking infrastructure, empowering financial institutions with scalable, technology-focused platforms for growth, compliance, and exceptional customer service.

- Contact for Pricing

-

Senso AI-Powered Agents For Financial Services

Senso AI-Powered Agents For Financial ServicesSenso provides AI agents designed to improve operational efficiency and staff productivity for financial institutions. Transform unstructured policies into structured knowledge for streamlined operations.

- Contact for Pricing

-

CAMS-ii Smart, simple and secure core processing for credit unions

CAMS-ii Smart, simple and secure core processing for credit unionsCAMS-ii is an AI-powered core processing system that provides credit unions with enterprise-level IT services, data management, and member services through a simplified browser-based network interface.

- Contact for Pricing

-

PCFS Solutions Modernized Loan Origination and Servicing for Business Lenders

PCFS Solutions Modernized Loan Origination and Servicing for Business LendersPCFS Solutions provides comprehensive loan origination and servicing platforms for business lenders, featuring automation, compliance tools, and seamless API integrations to streamline lending operations.

- Contact for Pricing

-

Floatbot Elevating Customer, Agent, and Employee Experience with Conversational AI Agents + Copilot

Floatbot Elevating Customer, Agent, and Employee Experience with Conversational AI Agents + CopilotFloatbot is a GenAI-powered platform offering Voice and Chat AI Agents, along with real-time agent assist, to automate customer interactions and improve efficiency across industries.

- Freemium

- From 99$

-

Addy AI Close mortgage loans in days, not weeks

Addy AI Close mortgage loans in days, not weeksAddy AI is an advanced mortgage lending platform that uses custom AI models to automate manual tasks in the mortgage process, helping lenders close loans faster and increase profitability.

- Contact for Pricing

-

Pinakyne AI-Driven Debt Collection for Financial Institutions

Pinakyne AI-Driven Debt Collection for Financial InstitutionsPinakyne leverages advanced AI agents to automate and personalize debt collection for financial institutions, enabling faster recovery rates and reduced operational costs.

- Freemium

- From 4$

-

BankGPT AI Assistant for Statements, Invoices & Receipts

BankGPT AI Assistant for Statements, Invoices & ReceiptsBankGPT is an AI platform that automates financial document processing, extracting and analyzing data from bank statements, invoices, and receipts for banks and enterprises.

- Freemium

-

AI Credit Repair AI-powered credit repair solution for identifying and removing credit report errors

AI Credit Repair AI-powered credit repair solution for identifying and removing credit report errorsAI Credit Repair is an advanced credit management platform that uses artificial intelligence to help users monitor, repair, and protect their credit through automated dispute resolution and personalized improvement strategies.

- Pay Once

-

Credit Time 2000 Metro 2® Credit Reporting Software for Comprehensive Bureau Compliance

Credit Time 2000 Metro 2® Credit Reporting Software for Comprehensive Bureau ComplianceCredit Time 2000 simplifies Metro 2® format credit reporting for businesses, enabling secure, error-free submissions to all major national and alternative credit bureaus.

- Paid

- From 50$

-

Flowtrics The Leader in AI Data, Task, Contract & Document Workflow Automation

Flowtrics The Leader in AI Data, Task, Contract & Document Workflow AutomationFlowtrics is an AI-powered platform designed to automate data, tasks, contracts, and document workflows, enhancing business process efficiency.

- Contact for Pricing

-

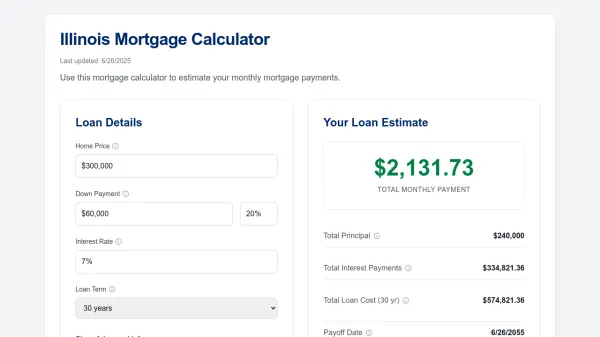

Illinois Mortgage Calculator Estimate Monthly Mortgage Payments in Illinois with Ease

Illinois Mortgage Calculator Estimate Monthly Mortgage Payments in Illinois with EaseIllinois Mortgage Calculator enables users to estimate their monthly mortgage payments by accounting for home price, down payment, interest rates, and loan term, giving insight into mortgage costs for Illinois properties.

- Free

-

LendingWise Automate and Scale Your Lending Business with Robust Loan Origination Software

LendingWise Automate and Scale Your Lending Business with Robust Loan Origination SoftwareLendingWise offers comprehensive cloud-based CRM and Loan Origination Software (LOS) to streamline, automate, and scale lending operations for private lenders, commercial brokers, and financial institutions.

- Contact for Pricing

-

BeetleLabs.ai Smart AI Agents For BFSI

BeetleLabs.ai Smart AI Agents For BFSIBeetleLabs.ai offers AI-powered agents to revolutionize customer support and engagement within the BFSI sector, enhancing efficiency and automation.

- Free Trial

-

FinBraine Next-Gen Lending Management and KYC Software

FinBraine Next-Gen Lending Management and KYC SoftwareFinBraine provides AI-powered lending management and digital KYC software solutions for Telecom, Retail, Banking, and eCommerce sectors.

- Contact for Pricing

-

Chart Instant Access to Verified Tax Records

Chart Instant Access to Verified Tax RecordsChart provides instant access to verified client tax records directly from the IRS and tax preparation software, automating income verification and client onboarding for fintech companies.

- Contact for Pricing

-

TartanHQ Redefining Enterprise Solutions with Unified APIs and Agentic Apps

TartanHQ Redefining Enterprise Solutions with Unified APIs and Agentic AppsTartanHQ offers unified APIs and agentic AI applications designed to streamline enterprise operations across various industries like lending, insurance, banking, and HR tech.

- Contact for Pricing

-

Casca Process 10x more loans with an AI Assistant

Casca Process 10x more loans with an AI AssistantCasca is an AI-native Loan Origination System that helps FDIC-insured banks and non-bank lenders automate 90% of manual effort in business loan origination, featuring 24/7 AI loan assistance and intelligent document processing.

- Contact for Pricing

-

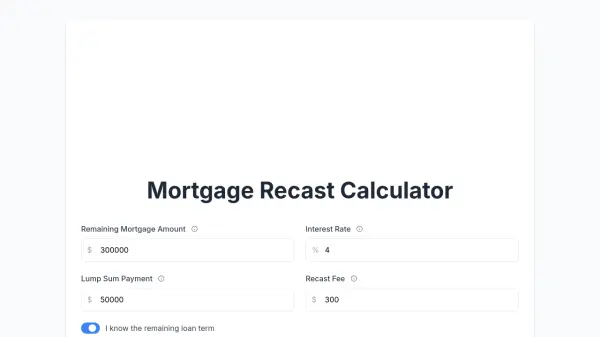

Mortgage Recast Calculator Easily Compute Savings from Mortgage Recasting

Mortgage Recast Calculator Easily Compute Savings from Mortgage RecastingMortgage Recast Calculator helps users estimate their new monthly payments and interest savings after making a lump-sum payment toward their mortgage principal, simplifying the mortgage recasting process.

- Free

Featured Tools

Join Our Newsletter

Stay updated with the latest AI tools, news, and offers by subscribing to our weekly newsletter.

Explore More Professions

Didn't find tool you were looking for?